Use the drop-down menu to explore a property:

|

Garage UnlimitedMonterey, CA

Frog Jump Plaza

Saich Way Station• 15,650 sq. ft. retail center fronting Stevens Creek Blvd. in Cupertino • $16,500,000 development • Construction began in summer of 2014; sale closed in summer of 2016 • Developed by (Saich Way Station, LLC) The Challenge A restaurant fire destroyed the previous retail strip mall in July 2009. Borelli worked closely with city officials to obtain the needed entitlements and planning approvals to develop an expanded retail center in Cupertino’s desirable Heart of the City area. The Solution Designed and built a sleek, modern retail center with broad storefronts, stylish awnings and attractive colors. Integrated many pedestrian- and cyclist-friendly elements including paved stone walkways and outdoor seating areas, as well as California Green features. The Results Signed major national and local tenants including a drug store, quick-fire pizza and fast-casual restaurants, mobile retailer, tax preparer, optometrist, and several computer businesses. Achieved 95% occupancy in 18 months and successfully sold the property to investors two years after start of construction. Click for more information.

Ringwood Business Center• 47 business condominiums, 72,000 sq. ft., San Jose • $ 16 million • 2003 • Developed by Borelli Investment Company The Challenge When a six-building corporate campus in North San Jose was sold in the summer of 2003, a five-acre parcel of land at the end of a cul-de-sac was excluded from the transaction. Borelli assembled an investor group and quickly raised $ 2 million to purchase the odd piece of land. The Solution Borelli orchestrated a zoning change from R&D to general commercial and obtained needed entitlements within six months. This enabled the construction of a three building, 72,000 sq. ft. business condo complex, with a unique “Main Street†design and units as small as 750 sq. ft. The Results Within 90 days, more than 80% of the 47 units were either sold or in escrow, leading to an early sellout. Initial invested capital grew by approximately 250% providing investors with highly desirable returns. Twin Palms• 50,400 sq. ft. of office space, Santa Clara • Current Value $ 5 million • 1972 • Developed by Twin Palms  The Challenge In 1972, Borelli Investment Company built a 50,400 sq. ft. multi-tenant industrial complex on Aldo Avenue in Santa Clara. In the mid to late 1970's the chassis of the Apple II computer was manufactored in this complex. The Solution Borelli has actively managed the property to maintain the buildings in good functional condition with ample power and market-ready interiors. Aggressive leasing and management has provided stability to the owners, maintaining the average occupancy at close to 100% for almost 40 years. The Results Occupancy continues to be at or near 100% — yielding steady cash flow on a free and clear basis to the owners. Bonaventura• 67,000 sq. ft. of office space, San Jose • Partial Disposition $ 2.5 million • 1978 • Developed by Art Nel Vic  The Challenge In 1978, Nelo Borelli — company founder and Ralph’s father — purchased four acres of land and built three industrial/R&D buildings in San Jose. One was a build-to-suit for Alerco Manufacturing. The other two were multi-tenant industrial buildings.  The Solution Over time, Alerco outgrew its build-to-suit. Borelli Investment Company refurbished the space, leased it and sold it for a nice return.  The Results The remaining two buildings continue to be managed and leased by Borelli and provide a steady cash flow for the owners.

San Jose Office Plaza• 64,000 sq. ft. office space, San Jose • $ 12 million • 1988 • Developed by Airport IV The Challenge Borelli was approached through its mortgage-banking correspondent to purchase 55 OP, a 64,000 sq. ft. office/R&D complex being offered as an REO by Crown Life Insurance. The purchase price was approximately $86/sq. ft. for a total initial value of $ 5.6 million. The Solution Again, Borelli’s strategy was to position the complex for a larger leasing pool by creating spaces that appealed to the smallest start-ups or individuals. Once the suites were reconfigured, Borelli’s limited rollover costs to cosmetic items only — reducing capital expenditures. The Results In 2004, Borelli successfully sold the complex for $ 195/sq. ft. for a total value of approximately $ 12.5 million providing investors a return of approximately 127%.

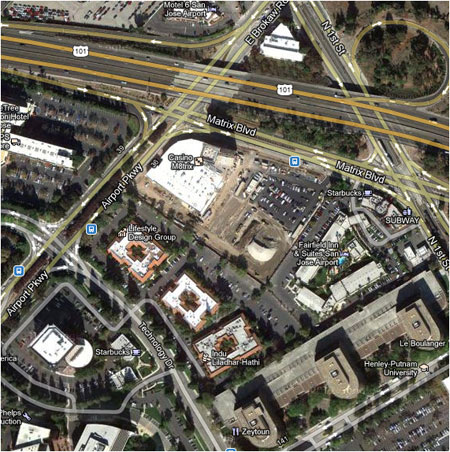

Airport Plaza Office Center• 55,000 sq. ft. of office space, San Jose • $ 13.8 million • 1985 • Developed by Borelli Investment Company  The Challenge When the syndicated investment group assembled by Borelli acquired Airport Plaza Office Center (APOC), it was a walk-up, garden-style office complex offering “Class B†space. The complex was being overshadowed by many newer office projects in the area.  The Solution Borelli positioned APOC to continuously provide the best value in the marketplace. A major renovation included features and amenities that were a first for Class B space in that area, differentiating the buildings from the competition. On-site management improved response time and financial controls.  The Results In 2004, Borelli rezoned one of the three buildings at APOC and completed $ 2.5 million in improvements to create AirTech Office Condominiums — which sold out very quickly. The other buildings maintained 95% occupancy through up and down economic cycles and were sold in 2006 for approximately 13.8 million. Orchard Business Plaza• 20,000 sq. ft. flex/industrial, San Jose • $ 18.6 million • 2006 • Developed by Orchard 209 The Challenge In 1979, Borelli Investment Company syndicated its first equity partnership. The fund raised $ 1.8 million in equity capital, and together with institutional financing, Borelli acquired a 120,000 sq. ft. flex/industrial building in San Jose for $ 4.25 million. The Solution Borelli renovated the building, dividing the space into smaller units to address a wide range of tenants. The company also increased the parking ratios, upgraded the landscaping, and provided on-site marketing and management for more timely response to tenant needs. The Results Borelli owned Orchard Business Plaza for 27 years. The building was refinanced several times, with some of the proceeds used to invest in other developments. Orchard Business Plaza was sold in 2006 for $ 18.6 million, an increase of over 400%. Investors who remained in the partnership to closeout received distributions that were 10 times their original investment.

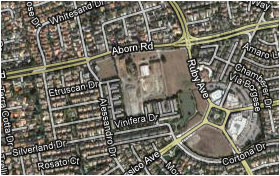

Berryessa Industrial• 88,000 sq. ft. in industrial condominiums, San Jose • $ 15 million • 2000 • Developed by Borelli Investment Company The Challenge In 2000, Borelli developed 88,000 sq. ft. of flex industrial space in a gated, five-building, master-planned development in San Jose. Fortunately, Phase I was 60% pre-sold at a healthy profit, because shortly after completion, the “dot-com†bubble burst, sending markets into a two-year spiral. The Solution To navigate the property through the challenging time, Borelli mapped the remaining space into industrial condos ranging in size from 5,000 to 11,000 sq. ft. — gaining access to a much deeper and wider pool of potential buyers. The Results Despite the dot-com market crash, Berryessa was sold in 2009, providing investors a 10% annual increase over the original cost.

Junction Office Center• 52 office condominiums, 77,400 sq. ft., San Jose • $ 17.5 million • 2011 • Developed by Junction OC, LLC The Challenge Borelli acquired an REO R&D/manufacturing complex in North San Jose. $ 10 million was raised from an equity partnership for a sweeping renovation and creation of 52 office condos. Early sales were strong, with 70% of the units sold by year-end 2007. Then came the Great Recession of 2008. The Solution While some developers walked away or hunkered down, Borelli turned to innovative marketing. Bold e-mail blasts to prospects, social networking, and a project blog raised the visibility of the property. TEAM Junction — a business-acceleration and mentoring group also differentiated the project. The Results By the spring of 2009, sales began to inch forward again. The final unit was closed in May 2011, almost 5 1/2 years after the first office condo closed. Prices had been driven down by up to 30% due to market conditions, but the project was successfully completed and sold for 17.5 million.

Hilton Garden Inn115-room hotel and conference center, Fontana $ 18 million, April 2009 Owned and developed by Sierra Hotel Group, LLC The Challenge An existing group had invested significant time and effort developing the hotel and working with the city of Fontana on needed entitlements. But although this group had received approval for the project, they were unable to obtain the building permits and raise the money required to begin construction. The Solution Borelli Investment Company assembled a partnership group — Sierra Hotel Group, LLC — to take over the project. Borelli successfully raised the required capital in a short timeframe and secured the necessary building permits to build the hotel. The Results The Hilton Garden Inn, Fontana, opened in April, 2009 to highly positive reviews — including earning a 96% rating from Hilton. The four-story hotel features well-appointed guest rooms and suites, a 24-hour business center, and 2,600 square feet of flexible meeting space — as well as a location close to the Ontario Airport and the nearby Auto Club Speedway (formerly California Speedway). De La Cruz• Development - 24 industrial condominiums, 51,000 sq. ft., Santa Clara • $ 4.1 million • 1984 • Developed by Borelli Investment Company The Challenge In 1984, a Borelli-managed investment partnership purchased an aging 51,000 sq. ft. incubator industrial building in Santa Clara. On October 19, 1987, Black Monday saw the Dow Jones average plummet 22.6%, sending the economy into turmoil. The Solution Borelli responded by successfully obtaining approval from the City of Santa Clara to renovate the property and convert the building into 24 industrial condos. A new loan was negotiated, and sources were identified to provide SBA financing when required by buyers. The Results Sales of the units averaged $ 80/sq. ft., for a total valuation of $ 4.1 million. Partners received 100% of invested capital at close in 1992, even in the face of the economic downturn. Those who opted to exit the project by taking title to a condo in lieu of equity ultimately sold their units for additional returns.

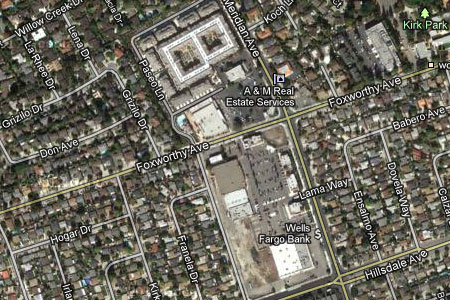

Hacienda Gardens Shopping Center• 250-unit new home community, San Jose • $ 31.5 million • 2005 • Developed by Toll Brothers The Challenge By 2005, Hacienda Gardens’ time had passed, with larger regional malls overshadowing the run-down 1950s –era shopping center. But surrounded by well-kept residential neighborhoods, Hacienda Gardens was ideally suited to be repositioned for high-density residential. The Solution KT Properties divided the old shopping center into two parcels. On one, it built a master-planned, mixed-use development. The remaining ten acres were marketed to homebuilders. Borelli proposed a creative disposition process that solicited bids on an un-priced basis from a dozen qualified homebuilders — essentially creating an auction. The Results Borelli’s collaborative efforts with KT Properties brought a winning bid that represented a substantial value enhancement to the seller — and a good deal for the buyer, Toll Brothers, which is building a community of approximately 200 townhomes and condominiums on the property.

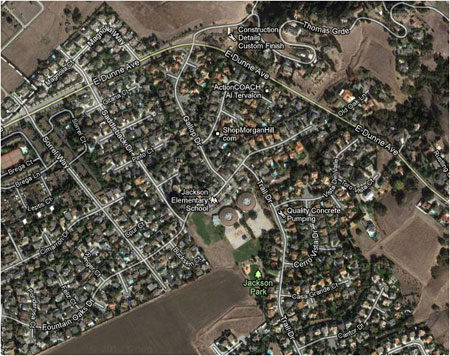

Jackson Oaks117-unit new home development, Morgan Hill $ 11.8 million • June 1988 Developed by Dividend Development Group The Challenge A Japanese development company had owned the property in Morgan Hill for many years and had been unable to develop it. The Solution Silicon Valley Diversified, a local homebuilder, devised a practical development approach. Dividend Development Group became interested. Ralph Borelli represented both parties in the transaction, seeing it through several near-“deal-breakers†before closing the transaction. The Results Consistent communication was the key to holding the deal together. Each time a renegotiation occurred, the property’s value increased — ultimately providing a nearly 400% gain in nine months — while paving the way for Dividend Development’s construction of a new home community.

Tuscany Hills• 937-unit new home development, San Jose • $ 31.4 million • June 1997 • Developed by KB Home/Western Pacific Housing The Challenge Major infrastructure issues held up the development of San Jose’s Communications Hill. No access roads. Water available only about halfway up the hill. Massive grading and tons of topsoil needed due to serpentine asbestos. The hill was also divided into multiple parcels owned by different individuals and entities. The Solution Borelli Investment Company worked closely with the various property owners, other brokers, and KB Home over more than two decades to play a key role in assembling seven parcels into the largest contiguous piece of undeveloped land on the Valley floor. The final parcel totaled approximately 125 acres with a combined sales price of about $ 31.4 million. The Results Western Pacific Housing constructed 217 homes. KB Home moved more than 30 million cubic yards of dirt and invested over $ 100 million in infrastructure improvements to build Tuscany Hills, a community of 720 homes and three neighborhood parks. Borelli’s ability to build trust won the day and made the new home community a reality.

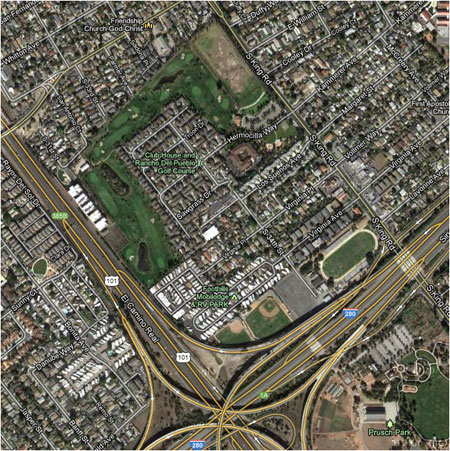

Thunderbird Golf Course• Mixed-use residential community, San Jose • $ 12.8 million • June 1997 • Developed by Barry Swenson Builder and KB Home The Challenge Although it was in a serious state of disrepair, the neighbors wanted to keep the golf course. There were traffic mitigation issues, zoning issues (to change from industrial to residential), and open space issues. In addition, at the start of the project in 1992, the financial markets were poor. The Solution Identified Swenson as the developer for a mixed-use community with 200 single-family detached homes and 100 units of affordable housing for seniors. Convinced the city to build a 9-hole golf course through a Community Facilities District (CFD) bond sale. Included affordable market-rate housing built by KB Home. The Results Worked diligently over five years. In the end, produced a much better result than the one million square feet of industrial space called for in the general plan. Provided mixed-use housing and beautiful new entry-level golf course in an in-fill area in one of San Jose’s poorest neighborhoods.

San Jose Flea Market• 120-acre, mixed-use community, San Jose Berryessa • Projected total land development $ 200 million • Phase I closed February 2013 • Developed by Flea Market The Challenge Over a half century, the San Jose Flea Market grew from a small swap meet to become a true Northern California landmark. Today, 6,000 vendors, a 1/4-mile-long farmer’s market, snack bars, roving food carts, and a kids’ FunZone attract more than four million visitors annually.  The Solution Working closely with the family owners of the 120-acre parcel, Borelli Investment Company is helping to develop Market Park — a master-planned, mixed-use transit village called the largest and most significant such development in Silicon Valley. It will stand at the termination point for the Berryessa BART extension, scheduled to be completed in 2018. The Results Phase I — consisting of 242 single-family detached homes and detached and conventional townhomes out of a prospective total of 2,800 residential units — is currently in escrow. To KB Homes it is anticipated to close in the first quater of 2013.

One South Market• 285 high rise, luxury-living apartments • Land developed $ 8.5 million • 2008 • Developed by KT Properties The Challenge In 2007, KT Properties built Axis, a 22-story, 44,300-sq. ft. high-rise condominium tower in downtown San Jose. The luxury residences sold well, and KT Properties was looking to acquire additional property in prime downtown San Jose locations to build similar towers. The Solution Borelli Investment Company leveraged its long-time network of relationships to identify 40,000 sq.ft. parcel of land at the corner of Santa Clara and Market Street - bringing it to the attention of KT Properties' decision-makers before the propety was even listed for sale. The Results In 2008, KT Properites acquired a long-term option in an off-market transactions on this ideally located property. It and Essex Property Trust - A Palo Alto-based apartment developer - recently filed a site development permit for a mixed-use, 21 story, 285-unit luxury apartment tower with approximately 6,000 sq. ft. of retail and underground parking at One South Market in downtown San Jose.

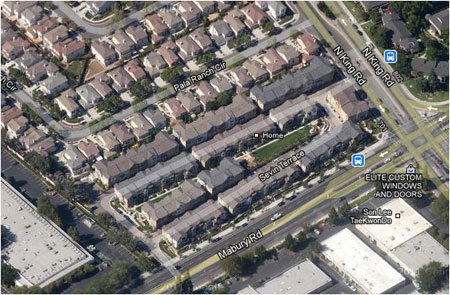

King Road• 91-unit new home development, San Jose • $ 13.1 million • July 1999 • Developed by Greystone Homes The Challenge The property was owned by three different parties, one of whom needed a tax-deferred exchange to another residence. A general plan change from industrial to residential would be also required, and the city planning staff was originally opposed to the development. The Solution There were major infrastructure issues with sanitation and the handling of storm water. The city also required an affordable housing component and wanted to incorporate “Youth Build†— a trade school program to help young adults with challenges gain experience with construction and development. The Results Greystone Homes completed 91 single-family residences. The judicious use of the “Youth Build†program yielded a greater profit on the sale of the affordable housing units. Converting the land from industrial to residential increased the land’s value approximately 400%.

Mirassou Winery• 107-unit new home community, San Jose • $ 10.6 million • January 2002 • Developed by KB Home The Challenge The Mirassou family had begun selling its San Jose vineyards as the land became too valuable for agricultural uses. Previous development phases had been done through a builder/developer other than KB Home. Ralph Borelli was brought in by the family attorney as a second option. The Solution Through skillful negotiation, Borelli brokered the property for KB Home, while obtaining an increase of more than 300% above the original offer to the Mirassou family for the land. The Results The Mirassou family received appropriate value for the land. KB Home was able to build a beautiful 107-unit, high-density residential community in a highly desirable location in the East Valley foothills.

Village One• 94-unit new home community, Modesto • $ 4.7 million • April 2004 • Developed by KB Home The Challenge The housing plots had been mapped by a developer/land speculator who was not an experienced homebuilder. The plot plan would have never been approved by the city. The Solution Borelli Investment Company engineered a transaction that was more of a trade than a purchase. The transaction met the needs of the seller and provided KB Home the opportunity to design and build a new home community that would win the city’s approval. The Solution The transaction took place at an optimal time in the market, so it was very successful for both the seller and KB Home. Borelli ensured that the entire process went smoothly was relatively uncomplicated and painless for all parties.

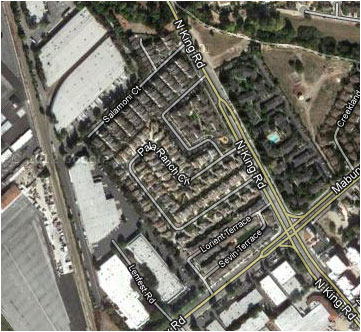

Salamoni Court• 78-unit new home community, San Jose • $ 16 million • December 2004 • Developed by KB Home The Challenge A swath of land needed for flood control running through the middle of the property essentially made the parcel valueless to homebuilders. Any sale would also require changing the zoning from industrial to residential. The Solution With extensive lobbying and land planning in conjunction with HMH Engineers, Borelli was able to substantially reduce the flood control easement from 200 ft. to 60 ft. A street was placed right over the flood control area to open the parcel. With this done, Borelli was able to obtain the residential zoning needed. The Results KB Home built a unique community of detached townhomes that enabled it to fit 78 single-family homes onto 5.5 acres. The property value was increased 400% through the sale to KB Home.

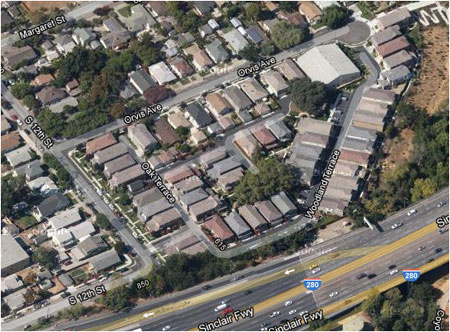

San Jose Christian College• 60-unit new home community, San Jose • $ 5.3 million • December 2004 • Developed by KB Home The Challenge The transaction was exceptionally complicated. Eight historic buildings were on the property. Rezoning was required from educational to residential use, and affordable housing units were specified. The broker representing the seller was reticent to work with Borelli or KB Home. The Solution Ralph Borelli presented the deal to his client, KB Home. The needed residential entitlement was obtained. Finally, KB Home sold the portion of the property with historic structures on it to another developer, who incorporated the required affordable housing units into the property. The Results Hard work and persistence paid off in the development of 60 badly needed residential units — including affordable housing — at 12th Street and Orvis, east of San Jose State University.

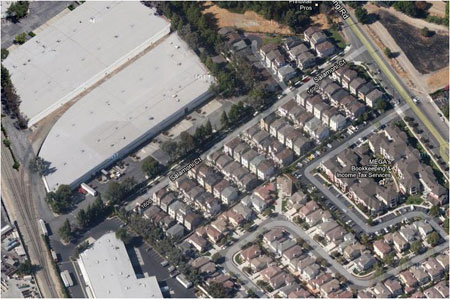

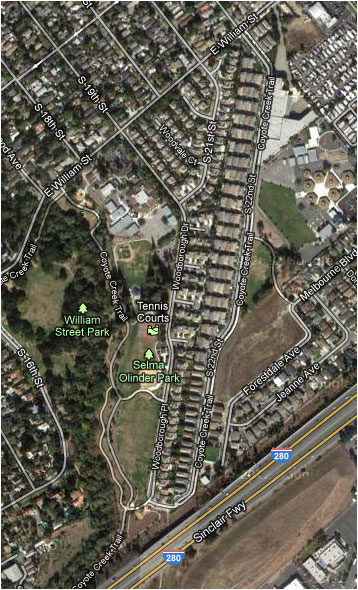

Union Pacific Railroad• 105-unit new home community, San Jose • $ 13.3 million • 2005 • Developed by KB Home CHALLENGE The land had initially been under contract to a different buyer — but complications had arisen. Testing had revealed the 18-acre parcel needed a substantial environmental cleanup — at a cost of at least $ 7 million. This caused the initial client to back away from the deal. SOLUTION Representing KB Home, Borelli Investment Company worked diligently and creatively with the owner, Union Pacific Railroad. Borelli identified an environmental company — that backed by a risk transfer agreement through ING —guaranteed the cost of the cleanup would not exceed $ 7 million. After nearly three years of work by Borelli, KB Home was ready to build. RESULTS A blighted area has been cleaned up, benefiting the surrounding neighborhood. In addition to building a 105-home new community, KB Home will complete a portion of the Coyote Creek Park trail that runs through San Jose. Union Pacific benefited from the profitable sale of excess land.

Almondridge Antioch• 110-unit new home community, Antioch • $ 11 million • March 2006 • Developed by KB Home The Challenge Obstacles arose connected with any development along the Highway 4 corridor. A moratorium was instituted until Highway 4 widening could be completed, preventing KB Home from obtaining the needed final entitlements from the city. The Solution Ralph Borelli brought KT Properties into the deal at the last minute to “warehouse†the opportunity before the option expired. KT Properties purchased the property with a 24-month buyback option for KB Home, contingent upon resolution of the Highway 4 issue. The Results In the summer of 2005 — with Highway 4 funding in place and the road ahead clear once more — KB Home bought the parcel back from KT Properties at a 50% increase in value. KB Home was then able to complete the residential community, and both parties profited.

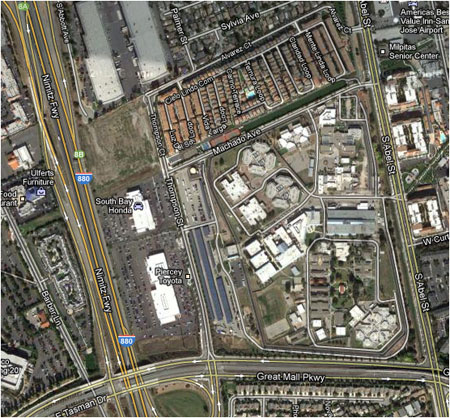

Elmwood (Luna)• 750-unit new home community, Milpitas • $ 57.7 million • Developed by KB Home The Challenge Santa Clara County wanted to sell two surplus parcels totaling nearly 50 acres adjacent to the Elmwood Correctional Facility. Ralph Borelli brought the opportunity to the attention of KB Home. While owned by the county, the parcels would also require entitlements from the City of Milpitas and the Milpitas Redevelopment Agency — making the transaction more complex. The Solution To complete the deal, KB Home and Borelli Investment Company had to work diligently with the Milpitas Planning Department and Redevelopment Agency to annex the land to the City of Milpitas. KB Home managed most of the entitlement process, including the production of an Environmental Impact Report (EIR). The project also entailed the expansion and extension of the Redevelopment Agency, which required the approval of the county. The Results KB Home created pads and made infrastructure improvements for a large automobile dealership fronting busy I-880. On the rest of the property, KB Home is building a $ 500 million, 750-unit community of single-family homes, townhomes, and condominiums. The county generated $ 150 million from the sale and the commercial ground lease. And Milpitas estimates the value of the sales taxes and property tax revenue from the auto dealership at $ 2.4 billion over 30 years.

Las Vegas• 80-unit new home community, Las Vegas, NV • $ 2 million • 2005 • Developed by Pinnacle Homes The Challenge The seller had a 5-acre parcel of land that had not been zoned, subdivided, or included under the city’s general plan. The Solution Borelli annexed the property to the City of Las Vegas and obtained zoning entitlements for high-density, single-family, detached homes. Because Las Vegas is outside of Borelli’s target market, local consultants were engaged and more than $ 100,000 was spent on legal and consulting fees in 18 months. The Results With the subdivision approved, the land sold for $ 2 million — compared to the original $ 600,000 offer on the property. The required investment in consulting and legal fees was turned into a very nice profit for the satisfied seller.

Morrison Park• 250-unit apartment complex, San Jose • $ 19.5 million • 2008 • Developed by Castlegroup The Challenge The 4.4-acre property in downtown San Jose needed to be rezoned to residential. In addition, there were a number of structures on the property that appeared to be historic and would therefore need to be preserved. The Solution Borelli established a close rapport among the seller, developer, and others involved in the transaction to address the significant challenges. Meeting monthly for four years — and more frequently as a deal drew near — it was determined all but one of the structures were not historic, so most buildings didn’t need to be preserved. The Results The Castlegroup saved $ 2 million by not having to move the existing 1930s era structures on the property. This more than offset the $ 200,000 invested over an intense eight months resolving the issue. With the path cleared, the Castlegroup proceeded with the development of its 250-unit complex.

Cherry Acres• 65,000 sq. ft R&D/90-unit townhome communiy, San Jose • $ 9 million • 1984 and 2006 • Developed by Borelli and KB Home The Challenge In 1984, a Borelli and a joint-venture partner purchased four acres of orchards and built a 65,000 sq. ft. R&D building. Shortly after the facility was completed and leased, the R&D market in San Jose suffered a severe decline. Borelli struggled to keep the building leased, signing short-term leases for maximum flexibility. The Solution Borelli negotiated a difficult General Plan change with the City of San Jose to convert the property to high-density residential. KB Home was brought in to build 90 townhomes, and at KB Home's request, Borelli also helped arrange short-term, off balance-sheet financing with third party investors. The Results With the required zoning approvals in place, Borelli demolished the existing R&D building, and KB Home successfully developed the townhome community. The City of San Jose got badly needed, high-density housing. And Borelli and its partners achieved an approximately 75% increase in yield over the alternative of simply selling the R&D building. A win-win-win!

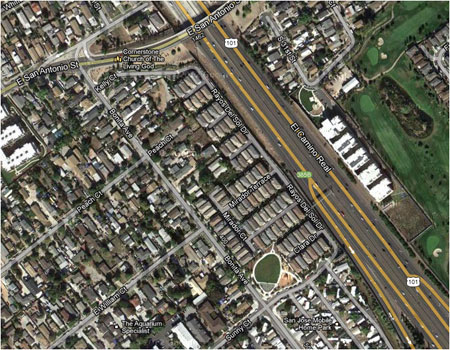

Sorrento Autumn Terrace at Bonita• 80-unit new home community, San Jose • $ 14 million • November 2005 • Developed by KB Home The Challenge The property was originally the site of the California Cheese Company. Rather than broker the land transaction, Ralph was asked to assemble a group of investors — which would enter into an “off-balance sheet†financing arrangement with an option to repurchase agreement with KB Home. The Solution Borelli Investment Company took advantage of the close relationships it maintains with banks to find financing for the project. During the holding period, Borelli paid 6% interest to the bank, while charging KB Home 9% interest — enabling Borelli to make a reasonable profit without a brokerage fee. The Results With the financing and entitlements it needed, KB Home obtained a construction license to complete the demolition and site development on the land now owned by the new partnership. KB Home then exercised its option and purchased the property in eight phases to develop an 80-unit residential community.

Cochrane & Hwy 101• 65 acre, 650,000-sq. ft. retail development, Morgan Hill • $ 29.5 million • August 2005 • Developed by JP DiNapoli Companies & Browman Development Challenge Land had been passed from generation to generation, creating a jigsaw puzzle of parcels and entitlement issues. One parcel was embroiled in a court-ordered sale due to a partnership dispute. Another was not for sale, but would only be made available as part of a joint venture agreement. Attempts by other developers to first build homes and then office buildings, had caused multiple zoning changes — but all attempts had failed. The Solution After nearly three decades of behind-the-scenes spadework, Borelli managed to assemble the patchwork of parcels to complete the land transaction, and brought in leading developers to begin construction of a contemporary 650,000 square foot, 65-acre retail center to begin. The Guglielmo Winery family participated in the transaction as a joint venture partner. The Results Developers J.P. DiNapoli Companies, Inc. and Browman Development Company designed a retail center built around a large Super Target store, and other major anchor tenants such as Petco, Staples, and Cost Plus World Market — as well as quality chain restaurants.

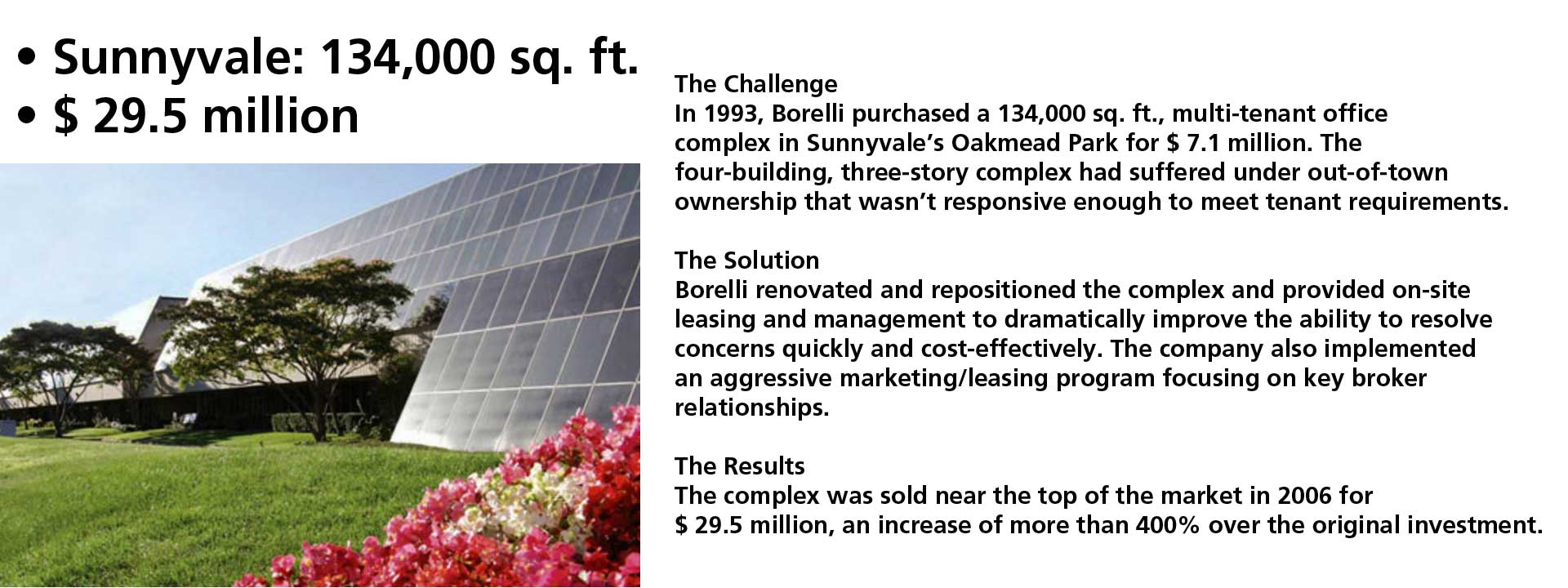

Oakmead Terrace• 134,000 sq. ft. of office space, Sunnyvale • $ 29.5 million • 2006 • Developed by Borelli/ Salera 15  The Challenge In 1993, Borelli purchased a 134,000 sq. ft., multi-tenant office complex in Sunnyvale’s Oakmead Park for $ 7.1 million. The four-building, three-story complex had suffered under out-of-town ownership that wasn’t responsive enough to meet tenant requirements. The Solution Borelli renovated and repositioned the complex and provided on-site leasing and management to dramatically improve the ability to resolve concerns quickly and cost-effectively. The company also implemented an aggressive marketing/leasing program focusing on key broker relationships.  The Results The complex was sold near the top of the market in 2006 for $ 29.5 million, an increase of more than 400% over the original investment.

B&B VI• 18,600 sq. ft. of office space, Cupertino • $ 4.7 million • 1984 • Developed by B&B VI  The Challenge In 1984, Borelli purchased a 18,600 sq. ft. multi-tenant office building in a prime location near the intersection of De Anza Boulevard and Highway 85 in Cupertino for $ 2.2 million.  The Solution The building was renovated with an emphasis on creating additional smaller spaces to accommodate startup companies and individuals. Borelli was also able to arrange variable interest rate financing — helping the project to better weather down cycles thanks to smaller mortgage payments.  The Results Borelli negotiated the placement of five cell phone antennas on the roof of the building, generating an additional $ 60,000 in annual cash flow. The building was sold with ideal market timing in 2007 for $ 4.7 million.

Mowry East Shopping Center• 20,000 sq. ft. of retail space, Fremont • $ 2.5 million • 2006 • Developed by Mowry TLC  The Challenge In a rising market in 2004, Borelli purchased a retail center in Fremont for $ 1.8 million. The center was only 60% to 70% leased at the time and needed a significant facelift to attract new tenants.  The Solution Borelli invested the funds necessary to modernize the retail center. A retail-leasing specialist was hired, and the center’s occupancy quickly rose to virtually 100%. The property was creatively set up as a tenancy in common (TIC) to address partnership needs.  The Results With the occupancy at nearly 100%, Borelli took advantage of a rapid increase in value to dispose of the property in 2006 for $ 2.5 million, achieving a 39% gain in approximately two years.

Paragon• 32,000 sq. ft. of office space, San Jose • $ 3.5 million • 2005 • Developed by Borelli Investment Company The Challenge Paragon was a 32,000 sq. ft. multi-tenant industrial building that Borelli and local partners purchased for $ 2.5 million in 2003. Occupancy was well below capacity, and the building had suffered from inadequate maintenance over the years. The Solution Borelli painted the building, improved the drainage, planted new landscaping, and increased parking ratios. An aggressive marketing and management effort brought the building to nearly 100% occupancy. The Results Again, with impeccable market timing, in 2005 Borelli sold the building for slightly more than $ 3.5 million, or $ 110/sq. ft.

Golden Pacific Office Center• 69,000 sq. ft. of office space, San Jose • $ 10.7 million • 2000 • Developed by Borelli Investment Company/Salera 18 The Challenge Golden Pacific Office Center is a two-building complex 69,000 sq. ft., located in western San Jose. In 2000, owner Comerica Bank approached Borelli — which was handling the leasing for the buildings — about purchasing the aging complex. The Solution Borelli bought the two buildings for approximately $ 5.1 million, or about $ 75/sq. ft., and invested capital to improve the property. Borelli was also able to secure Corinthian Schools (for its Everest College brand) as a key tenant, and negotiate a long-term leaseback with the bank. The Results With the buildings’ occupancy stabilized after three years, Borelli decided to sell the complex for approximately 10.7 million and continues to manage the property today.

Fremont Business Park• 120,000 sq. ft. of office space, Fremont • Listed at $ 11.7 million • Sold – September 2012 • Syndicated by TriCastle The Challenge In mid-2009, Fremont Business Park — a multi-tenant office complex in southern Fremont — was showing its age and struggling to stay leased. Occupancy had fallen to just 35% at its lowest point, and the ongoing recession had eliminated most sources of financing. The Solution Borelli approached the equity partners and convinced them to provide $ 2.5 million in additional equity capital, so the complex could be extensively renovated. An aggressive marketing program was implemented that included a project micro web site, blog, HTML e-mails, and the TEAM Christy Street business-support group. Between 2009 and 2012, over 100 leases were negotiated in one of the most difficult leasing markets in history.  The Results By mid-2011, occupancy had reached 95%. The following summer, occupancy topped 97%, and rent increases were initiated. With the building well-positioned, Borelli listed the complex for sale for $ 11.75 million, selling it for an undisclosed figure in September 2012. Laurel I• 67,000 flex/incubator space, Santa Clara • $ 4.7 million • 1983 • Developed by Laurel I Partnership The Challenge Laurel I was an opportunity that Borelli was able to address by refinancing Orchard Plaza. Approximately four yeears after its development, Borelli refinanced Orchard B12 Plaza and used 3.3 million of the proceeds to buy Laurel I, a three-building industrial complex in Santa Clara. The Solution While Laurel I's spaces were properly sized for smaller businesses, much of the complex was in disrepair. Management and leasing had also been negatively impacted by absentee ownership, which was causing negotiations to take far too long for small businesses on tight timetables. The Results Borelli renovated the buildings and brought responsive, local management to Laurel I. The improved efficiency in closing lease transactions restarted the flow of transactions from brokers - resulting in a rapid lease-up of the buildings' vacant space. Laurel I was sold in 1996 for $ 4.7 million in aggregate. |